How Long Does GEICO Take to Fix Your Car? Understanding the Repair Timeline

Dealing with a car accident is stressful enough without the added worry of how long it will take to get your vehicle repaired and back on the road. If you’re insured with GEICO, you’re likely wondering, “How Long Does Geico Take To Fix A Car?” While GEICO aims to make the claims process as smooth as possible, several factors can influence the repair timeline. Let’s break down what you can expect and how GEICO works to get you back behind the wheel quickly.

When you file a claim with GEICO, they prioritize getting the process started promptly. GEICO advertises that claims can be settled in as little as 48 hours, which primarily refers to the initial claim processing and damage assessment, not the entire repair duration. To begin, you can easily file your claim online or call their 24/7 claims service at (800) 841-3000. This immediate accessibility is the first step in expediting your car repair journey.

Initial Damage Assessment and Inspection Timeline

After reporting your accident, GEICO moves swiftly to assess the damage to your vehicle. If your car is drivable, GEICO typically aims to schedule an inspection appointment for you within 24 hours. This initial inspection is crucial for determining the extent of the damage and creating a repair estimate.

For situations where your car is not safe to drive, GEICO demonstrates its commitment to convenience by offering to send an auto damage adjuster directly to your vehicle’s location. This eliminates the need for you to tow your car to a shop immediately and allows for a quicker start to the damage evaluation process. This on-site assessment helps accelerate the subsequent steps in getting your car fixed.

Repair Shop Options and GEICO Auto Repair Xpress Program

Once the damage assessment is complete, the actual repair timeline begins. GEICO allows you the flexibility to choose any repair shop you prefer. However, to potentially expedite the repair process and ensure quality service, GEICO offers its Auto Repair Xpress® program.

Choosing a shop within the GEICO Auto Repair Xpress network can offer several advantages. These facilities are pre-approved by GEICO, often leading to a faster repair initiation. During the inspection at one of these shops, which typically takes around 30 minutes, a Shop Representative will evaluate the damage and prepare a detailed estimate. Furthermore, GEICO provides a written lifetime guarantee on repairs performed at Auto Repair Xpress shops, assuring quality for as long as you own the vehicle. You can easily find an Auto Repair Xpress facility and contact GEICO to schedule your appointment.

If you have rental reimbursement coverage as part of your GEICO policy, utilizing the Auto Repair Xpress program can also streamline the process of setting up a rental car while your vehicle is being repaired. This coordinated approach aims to minimize disruption to your daily life.

Factors That Influence the Car Repair Timeline

While GEICO strives for a quick turnaround, the exact time it takes to fix your car can vary depending on several factors:

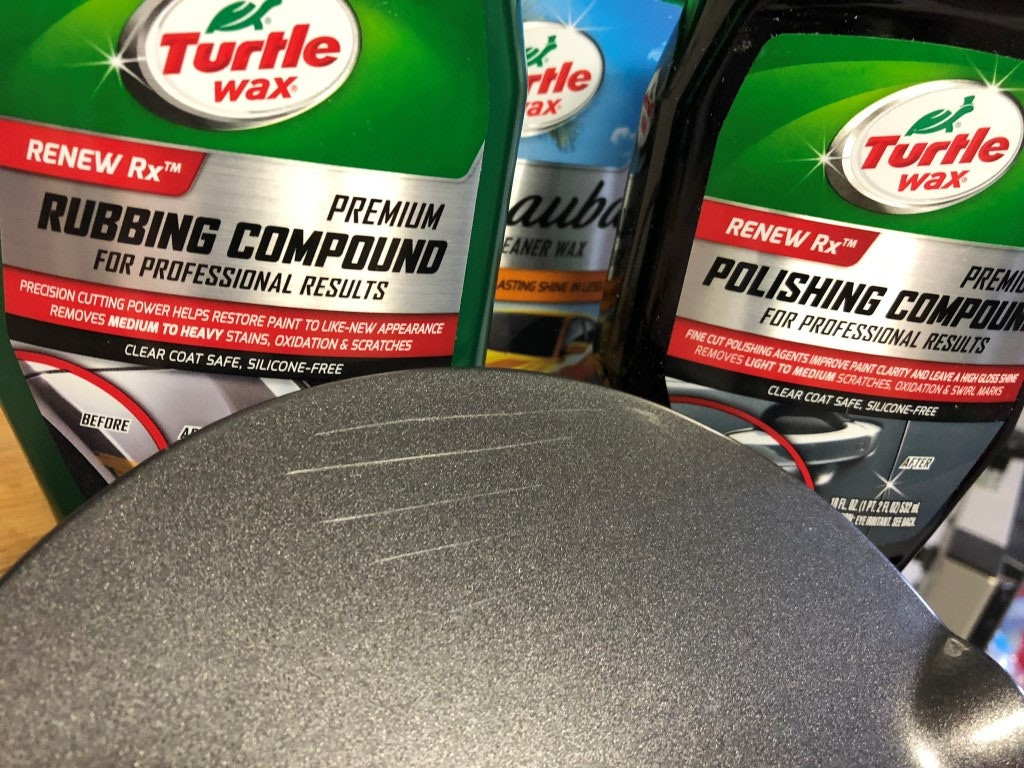

- Severity of Damage: More extensive damage naturally requires more time to repair. Minor dents and scratches will be fixed faster than significant structural damage requiring extensive bodywork or part replacements.

- Parts Availability: The availability of necessary replacement parts can significantly impact the repair timeline. If parts are readily available, repairs can proceed without delay. However, if specialized or back-ordered parts are needed, it can extend the overall repair time.

- Repair Shop Workload: The workload of the chosen repair shop also plays a role. Shops with high demand may have longer wait times for scheduling repairs and completing the work.

- Claim Complexity: In situations where liability is unclear or there are complexities in the claim, the overall process, including repair authorization, might take slightly longer as GEICO conducts necessary investigations.

Payment and Completion of Repairs

GEICO aims to issue payment for repairs as quickly as possible after the accident investigation is concluded and the repair estimate is approved. Payment is typically sent digitally or by mail and will cover the cost of repairs, minus any applicable deductible. The speed of payment from GEICO ensures that repair shops can proceed with the work without financial delays, contributing to a smoother process.

What to Expect When the Claim Isn’t Against You

If another driver is deemed at fault for the accident, GEICO will still manage your claim efficiently. However, it’s important to be aware that if the claim is against another party’s insurance, the investigation and settlement process might take a bit longer. GEICO will need to coordinate with the other insurance company to determine liability and process the claim, which can slightly extend the overall timeline compared to an at-fault claim against your own policy.

Conclusion: GEICO’s Commitment to Efficient Car Repairs

While there’s no one-size-fits-all answer to “how long does GEICO take to fix a car?”, GEICO is committed to making the repair process as efficient and hassle-free as possible. By prioritizing quick damage assessment, offering convenient repair options like the Auto Repair Xpress program, and aiming for prompt payment, GEICO strives to minimize the time you are without your vehicle. Remember that the actual repair duration will depend on the specifics of your situation, but GEICO’s focus is on getting you safely back on the road as soon as feasible. If you have any questions throughout the process, GEICO claims representatives are available at (800) 841-3000 to provide support and updates.