Can I Use My Car Insurance to Fix My Car? Exploring Your Options

It’s a common scenario: your car is damaged, and the immediate thought is, “Will my car insurance cover this?” Navigating the world of auto insurance can be confusing, especially when you’re dealing with accident repairs. Many car owners wonder if they can simply use their car insurance to fix their vehicle, regardless of the situation. The reality is, it’s not always a straightforward yes or no. Let’s delve into when and how your car insurance might help you fix your car, and what factors come into play.

Understanding the nuances of your car insurance policy is crucial. Not all policies are created equal, and the coverage you have significantly impacts whether you can use it to repair your vehicle. Typically, car insurance is designed to protect you from financial losses due to accidents, theft, or damage, but the extent of this protection depends on the type of coverage you’ve chosen.

Types of Coverage and Car Repairs

To understand if you can use your car insurance to fix your car, you first need to know the different types of coverage available:

-

Liability Coverage: This is often the minimum coverage required by law. It primarily covers damages you cause to others and their property if you are at fault in an accident. Liability coverage does not pay for repairs to your vehicle.

-

Collision Coverage: This coverage helps pay for repairs to your car if it’s damaged in a collision with another vehicle or object, regardless of who is at fault. If you drive into a pole, or another car hits you, collision coverage can kick in to help fix your car. It generally has a deductible, which is the amount you pay out-of-pocket before your insurance starts covering the rest.

-

Comprehensive Coverage: Often paired with collision coverage, comprehensive coverage protects your car from damages other than collisions. This includes events like theft, vandalism, hail damage, fire, or hitting an animal. Like collision, it usually has a deductible.

-

Uninsured/Underinsured Motorist Coverage: This protects you if you’re hit by a driver who either has no insurance or doesn’t have enough insurance to cover your damages. It can help pay for your medical bills and car repairs in these situations.

So, can you use your car insurance to fix your car? Generally, yes, but only if you have the right type of coverage and the damage falls under the policy’s terms. If you have liability-only coverage and you cause an accident, your insurance will help pay for the other driver’s car repairs, but not your own. However, if you have collision or comprehensive coverage, and your car is damaged in a covered event, your insurance can help pay for the repairs to your vehicle, minus your deductible.

When Insurance Might “Total” Your Car

Insurance companies sometimes declare a vehicle “totaled,” or a “total loss.” This doesn’t necessarily mean the car is beyond repair, but rather that the cost to repair it exceeds a certain percentage of the car’s actual cash value (ACV). Each insurance company and state has different thresholds, but it’s often around 70-80% of the ACV.

Here’s where the story of our family friend comes in, illustrating a less common but potentially valuable option: buying back a totaled vehicle. The original article mentions a woman in her 60s who bought back two “totaled” vehicles. In the case of her Ford Taurus wagon, the damage seemed relatively minor – dented doors. However, the insurance company likely determined that the cost of repairs at a body shop would be too high compared to the car’s value.

This highlights a key point: insurance companies are concerned with cost-effectiveness. They aim to minimize their payouts while still fulfilling their policy obligations. For older vehicles with lower ACVs, even seemingly minor damage can lead to a total loss declaration.

Buying Back Your Totaled Vehicle

If your insurance company declares your car a total loss, you have a few options. You can accept the insurance settlement, which is typically the ACV of your car minus your deductible. Or, you can negotiate to buy back your car from the insurance company.

When you buy back a totaled vehicle, the insurance company will reduce your settlement amount by the car’s salvage value. You then retain ownership of your damaged car. This might be a viable option if:

-

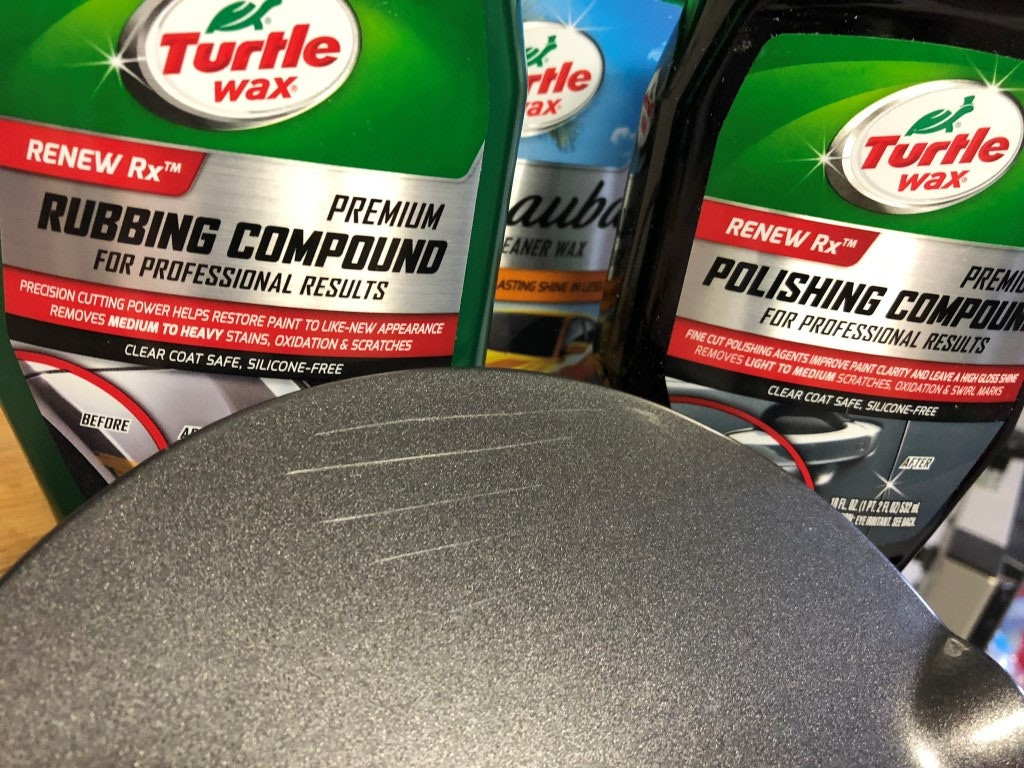

The damage is primarily cosmetic or you can repair it yourself or at a lower cost. As mentioned in the original article, bolt-on parts and DIY repairs can make fixing an older vehicle economically feasible, even if professional bodywork is too expensive for the insurance company.

-

You have a sentimental attachment to the car. The 1990 Honda Civic in the example was inherited, suggesting sentimental value that might outweigh purely financial considerations.

-

You need basic transportation and are willing to drive a car with a salvage title and potentially non-matching parts. The brother in the original example used his repaired van for two more years, prioritizing functionality over aesthetics.

However, buying back a totaled vehicle has important implications:

-

Salvage Title: The car will receive a salvage title, which can affect its resale value and future insurance options. You’ll likely need to get the car inspected and obtain a rebuilt title before it can be legally driven again.

-

Insurance Coverage: As the article points out, insurance companies may be hesitant to offer comprehensive or collision coverage on a vehicle with a salvage title. Liability coverage might still be available, but you’ll likely have fewer options and potentially higher premiums.

-

Safety: Ensure that any repairs are done safely and correctly, especially if they involve structural or mechanical components. A salvage title can raise red flags, and it’s crucial to prioritize safety.

Making the Decision: Repairing Your Car and Insurance

So, circling back to the main question, “Can I Use My Car Insurance To Fix My Car?” – the answer depends heavily on your coverage and the circumstances of the damage.

Here’s a simplified decision-making process:

- Assess the Damage: How extensive is the damage? Is it a minor dent, or major structural damage?

- Check Your Coverage: Do you have collision or comprehensive coverage? If not, your insurance likely won’t pay for your repairs if you are at fault.

- File a Claim (if applicable): If you have the right coverage and the damage is covered, file a claim with your insurance company.

- Get an Estimate: Obtain repair estimates to understand the potential costs.

- Insurance Assessment: The insurance company will assess the damage and determine if it’s covered and whether the car is repairable or a total loss.

- Consider Buyback (if totaled): If your car is totaled, weigh the pros and cons of buying it back and repairing it yourself.

Ultimately, understanding your car insurance policy is key to knowing your options when your car needs repairs. While you can often use your insurance to fix your car, it’s important to be aware of the different types of coverage, deductibles, and the potential implications of a total loss and salvage title. Carefully consider your situation and make informed decisions about your car repairs and insurance claims.