Do I Have to Fix My Car with Insurance Money? Understanding Your Options

When you receive a car insurance claim check after an accident, you might wonder, “Do I have to fix my car with insurance money?” The answer isn’t always straightforward and depends on several factors. Understanding these factors will help you make informed decisions about your car repairs and claim payout. This guide will clarify your options and responsibilities when it comes to using your insurance claim check.

When Your Insurer Pays the Repair Shop Directly

Many insurance companies prefer you use their network of “preferred” or “Direct Referral Program” auto body repair shops. While you generally have the freedom to choose any repair shop, opting for a preferred shop often means your insurance company will handle the payment directly. In this scenario, you won’t receive a check; instead, you’ll only need to pay your deductible to the chosen mechanic.

Choosing a preferred auto repair shop offers several advantages. Firstly, it can streamline the repair process as these shops often have established relationships with your insurer. Secondly, if any additional repairs are needed or issues arise after the initial work, both the repair shop and your insurance company typically cover the extra costs. This collaborative approach ensures efficiency and can save you from mediating between the repair shop and your insurance provider.

The Role of Lienholders: Permission May Be Required

If you are still paying off your car loan or lease, a significant factor influencing your control over the insurance money is the lienholder. Car lease and loan agreements commonly stipulate that you must maintain the vehicle in good condition throughout the agreement term. Often, these agreements require your financing company to be listed on your insurance policy. Consequently, any claim check issued by your insurer might include both your name and the lienholder’s name.

In such cases, you’ll need the finance company’s endorsement to cash the insurance check. The level of involvement and control your loan company exerts in the claims process can vary. Some lienholders may simply verify the accident details, sign the check, and allow you to proceed. However, it’s also possible that your loan officer will require you to endorse the check over to them, and they will manage the payment to the repair shop directly on your behalf.

It’s important to remember that even if the loan company’s name isn’t on the check, your lease or loan terms still obligate you to maintain your car’s condition. Repairing your car according to your lease agreement is advisable to avoid potential penalties at the end of your lease or even vehicle repossession.

When You Own Your Car Outright: Flexibility and Responsibility

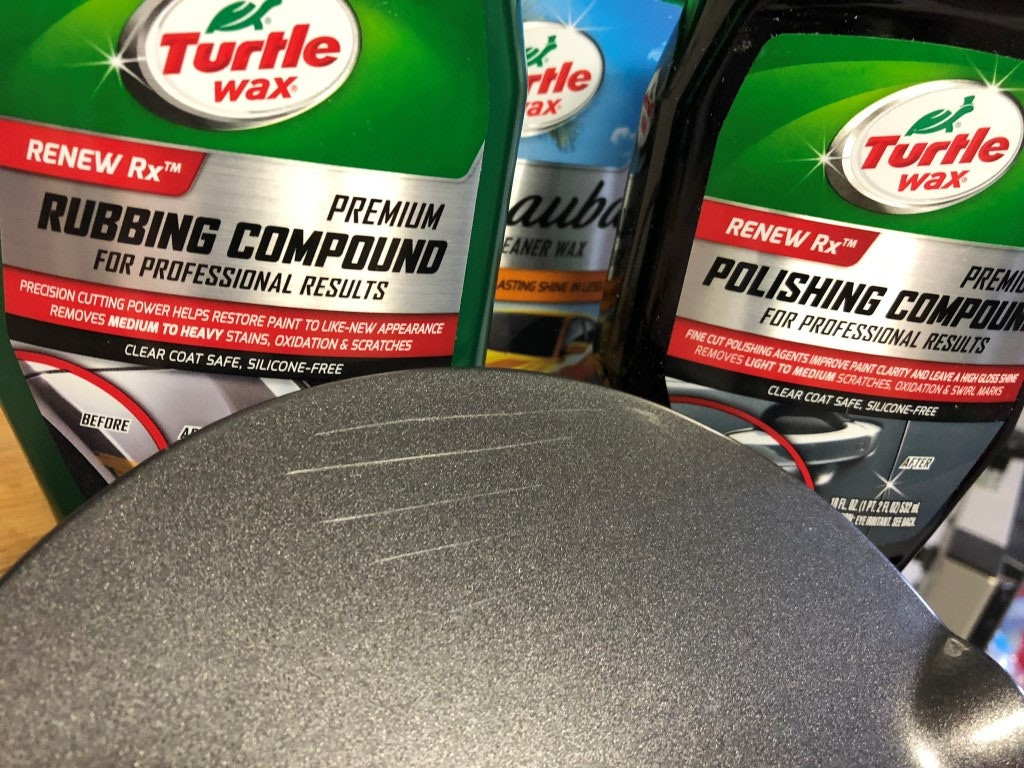

If you own your car outright and receive an insurance claim check, you have more flexibility. Technically, you are not legally obligated to use the insurance money to repair your car. You could use the funds for other purposes. However, before making this decision, it’s crucial to consider the potential implications.

The primary drawback of not using the insurance money for repairs is that you become responsible for any future issues arising from the unrepaired damage. Whether the problem worsens over time due to neglect or is exacerbated by unprofessional repair attempts, your car insurance company will not cover subsequent damage related to the original incident. You will be responsible for all further costs associated with these issues. Furthermore, insurance companies are cautious about repeated claims for the same damage and may deny future claims if they suspect fraud or pre-existing damage.

Can You Keep Leftover Insurance Claim Money?

Yes, if you own your car outright, any money left over from the insurance claim after repairs are completed is yours to keep. However, it’s unethical and potentially fraudulent to intentionally inflate repair estimates to pocket extra money. Always obtain repair estimates from reputable sources, such as trusted repair shops, to ensure accuracy and ethical conduct.

State Laws Regarding Insurance Claim Checks

Insurance regulations in the United States are primarily governed at the state level, which explains the variations in insurance rates and claims processes across different states. Therefore, specific state laws may dictate how insurance payouts are handled in your location.

For instance, Massachusetts law mandates that insurance companies issue claim checks directly to the policyholder unless explicitly requested otherwise. Additionally, some states require lienholders to be named on insurance policies and claim checks, while others do not.

It’s advisable to consult your state’s specific insurance laws and regulations to ensure both you and your insurance company are adhering to legal requirements regarding insurance claim checks and payouts. Understanding these state-specific rules is crucial for navigating the claims process smoothly and compliantly.

Disclaimer: This article provides general information and should not be considered legal or financial advice. Consult with a qualified professional for personalized guidance.