Do You HAVE to Fix Your Car with Insurance Money? Understanding Your Claim Options

After a car accident and filing an insurance claim, a common question arises: do you actually have to use the insurance money to fix your car? The answer isn’t always straightforward and can depend on a few key factors. Whether you have a car loan or lease, and the policies of your car insurance company, play significant roles in determining how much control you have over your car repair and the insurance claim check you receive. Let’s break down the common scenarios and help you understand your options when it comes to using your car insurance claim money for repairs.

How Your Insurance Company Might Handle Payments Directly

Many car insurance companies have established networks of preferred auto body repair shops, sometimes referred to as Direct Referral Programs. While you generally retain the right to choose any repair shop you trust, opting for a preferred shop often streamlines the repair process. In these cases, your insurance company will likely handle the payment directly with the repair shop. This means you may not even receive a physical insurance claim check. Instead, your responsibility is typically limited to paying your deductible directly to the mechanic.

One of the significant advantages of using a preferred auto repair shop is the added peace of mind. If any complications arise during the repair process, or if additional work is needed beyond the initial estimate, both the insurance company and the preferred shop typically cover these extra costs at no additional expense to you. This can significantly speed up the repair timeline and ensure efficiency. Furthermore, by choosing a preferred shop, you often eliminate the need to act as an intermediary between the repair shop and your insurance company, simplifying the entire experience.

The Role of Lienholders: Loan and Lease Considerations

If you are currently paying off a car loan or lease, there’s a good chance your lender or leasing company (known as the lienholder) has a vested interest in ensuring your vehicle remains in good condition. Most car lease and loan agreements stipulate that you must maintain the car in proper working order throughout the agreement term. This often translates into insurance requirements, where the lienholder is frequently listed as a payee on your insurance policy. Consequently, when you file a claim, you might find that the insurance claim check is issued jointly to both you and your lienholder.

In such instances, you’ll need the lienholder’s endorsement to cash the insurance check. The level of involvement your loan company will have in the claims process can vary. Some lienholders may simply verify the accident details, sign the check, and allow you to proceed with the repairs. However, it’s also possible that your loan officer will require you to endorse the check over to them, and they will then manage the payment directly to the repair company on your behalf. The extent of control ultimately rests with the lienholder.

It’s worth noting that situations differ in “third-party” claims, where the accident was the fault of another driver, and their liability insurance is covering the damages. In this scenario, the at-fault driver’s insurance company is unlikely to know, or be contractually obligated to, your financing company. Therefore, the settlement check in a third-party claim is typically made out directly to you.

Regardless of whether the lienholder’s name is on the check, remember that your loan or lease agreement obligates you to maintain your car’s condition. Therefore, repairing your car according to the terms of your agreement is always advisable. Failure to do so could lead to penalties at the end of your lease term or, in more severe cases, even vehicle repossession due to breach of contract.

When Repairing Your Car Is Not Mandatory

If you own your car outright, meaning you have no outstanding loans or leases, and your insurance company issues you a claim check, you technically have the freedom to decide how to use the money. You are not legally obligated to use it for car repairs. While the funds are intended to cover the damage to your vehicle, you could, in theory, use the money for other purposes.

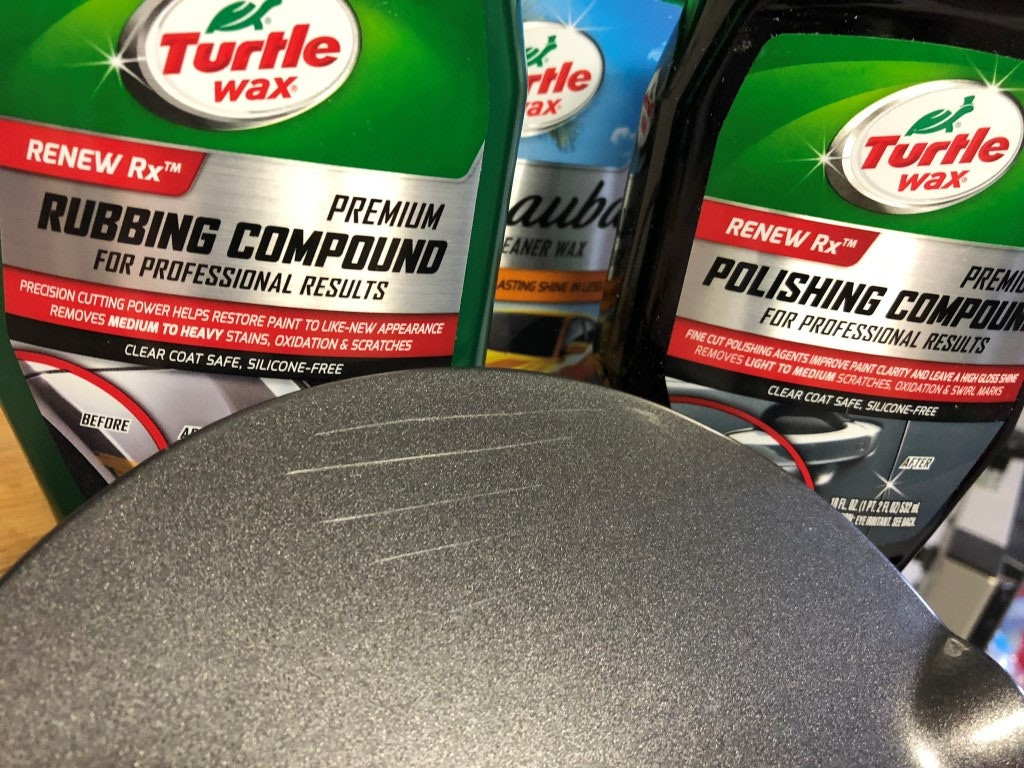

However, before you consider using your car insurance claim check for something other than repairs, it’s crucial to understand the potential drawbacks. The most significant risk is that you become fully responsible for any future costs if the vehicle problem worsens.

Whether the issue deteriorates over time due to neglect or is exacerbated by substandard repairs, your car insurance company will not provide further coverage for the same damage. You will be responsible for all subsequent expenses. Furthermore, insurance companies are vigilant about preventing fraud and are unlikely to cover repeated repairs for the same issue.

For instance, if your car sustains hail damage multiple times, your insurer will thoroughly investigate to ensure you are not attempting to file fraudulent claims. They are also likely to deny a claim if they find evidence of pre-existing damage, even if a new incident primarily caused the current damage.

What Happens to Leftover Insurance Money?

If you do choose to repair your car and own it outright, and the actual repair costs are less than the amount of your insurance claim check, you are generally allowed to keep the leftover money. However, it is crucial to avoid intentionally inflating repair estimates. Always obtain estimates from reputable sources, such as trusted repair shops, to ensure accuracy and ethical practices.

State Laws and Insurance Claim Payouts

It’s important to remember that insurance regulations in the United States are primarily governed at the state level. This is a major reason why car insurance rates can vary significantly from state to state. Consequently, specific state laws may dictate certain procedures for handling insurance payouts.

For example, in Massachusetts, insurance companies are legally required to issue claim checks directly to the policyholder unless the insured person explicitly requests otherwise. Additionally, some states, but not all, mandate that lienholders (your lease or loan company) must be named on both insurance policies and claim checks to protect their financial interests.

To ensure you and your insurance company are adhering to all legal requirements, it’s always wise to double-check your specific state’s laws and regulations regarding insurance claim checks and payouts. This can prevent potential complications and ensure a smooth claim process.

In Conclusion

Navigating car insurance claims and repair payments can seem complicated, but understanding your obligations and options is key. While you may not always be legally required to use insurance money to fix your car, especially if you own it outright, there are significant factors to consider. Lienholders often have a say in how claim money is used, and neglecting repairs can lead to future financial burdens and coverage issues. Always be informed about your policy, your state’s laws, and make decisions that align with your best interests and financial well-being.