Can You Fix Your Own Car with Insurance Money? What You Need to Know

Dealing with the aftermath of a car accident is stressful enough, from potential injuries to navigating insurance claims. Once the dust settles, you’re often faced with repair bills that can feel overwhelming. Like many car owners, you might be wondering if there’s a way to cut costs, perhaps by handling the repairs yourself. A common question arises: Can You Fix Your Own Car With Insurance Money after an accident?

This article will explore whether you can use an insurance payout to repair your vehicle yourself, what to consider if you’re thinking of DIY repairs, and potential implications for your claim. We aim to provide you with a clear understanding of your options and empower you to make informed decisions about your car repairs after an accident.

The experienced injury attorneys at Phoenix Accident and Injury Law Firm are dedicated to supporting clients through every step following a car accident, including navigating vehicle repairs and insurance claims. With conveniently located offices in Chandler, Peoria, and North Phoenix, they offer consultations in person, by phone, or via video call.

Fixing Your Car with an Insurance Payout: The Basics

The short answer is yes, generally, you can fix your own car if you receive an insurance payout. The key factor is the type of insurance coverage you have. Policies like collision or comprehensive coverage have maximum payout limits, which were defined when you initially set up your policy.

As long as the necessary repairs fall within these coverage limits, you are typically entitled to manage the repairs yourself. While our legal team often advises receiving the insurance funds before starting any work, we understand the desire to start repairs immediately, especially if you have the skills or resources to do so.

Alt text: Car with significant damage to the side panels after a traffic collision, parked on the roadside.

Are You a Mechanic? Or Know Someone Who Is? Payout Considerations

If you are a skilled mechanic or have connections to one who can provide repair estimates, this can be valuable when dealing with your accident case and attorney. Insurance companies often seek professional opinions on repair costs, and your estimate can serve a similar purpose.

However, proceed with caution. If you choose to begin repairs before filing a claim or obtain an initial repair valuation that is lower than what a third-party assessor would provide, you might not be able to claim additional funds later if the insurance payout is less than expected.

It is generally recommended to file a claim with your insurance company first and have the damage assessed professionally. This ensures you have a clear understanding of the potential repair costs before making decisions about DIY repairs, even if you are experienced or know someone who is. Discrepancies in quotes can arise, and you could potentially lose out on entitled compensation if you undervalue the damage.

Keeping Any Excess Funds from Your Insurance Claim

Yes, in many situations, you are allowed to keep any money left over from an insurance claim after repairs are completed. This often depends on who owns the vehicle and the specifics of your insurance policy.

- Vehicle Ownership: If you fully own your car, meaning there are no loans or leases, and the insurance payment is more than the actual repair costs, you usually can keep the difference. For example, if you get a $3,000 insurance check, but repairs only cost $2,500, the remaining $500 is yours.

- Financed or Leased Vehicles: If your car is financed or leased, the insurance payout might be sent directly to the repair shop or the lienholder. Any remaining funds would typically go back to the insurer or be used to reduce the outstanding loan amount.

- Policy Terms: Always review your insurance policy details. Some policies specify how payouts must be used. Contacting your insurance agent can clarify these details.

It’s also worth knowing that some states have specific rules about insurance payouts and how they can be used. It’s wise to check local regulations to be fully informed.

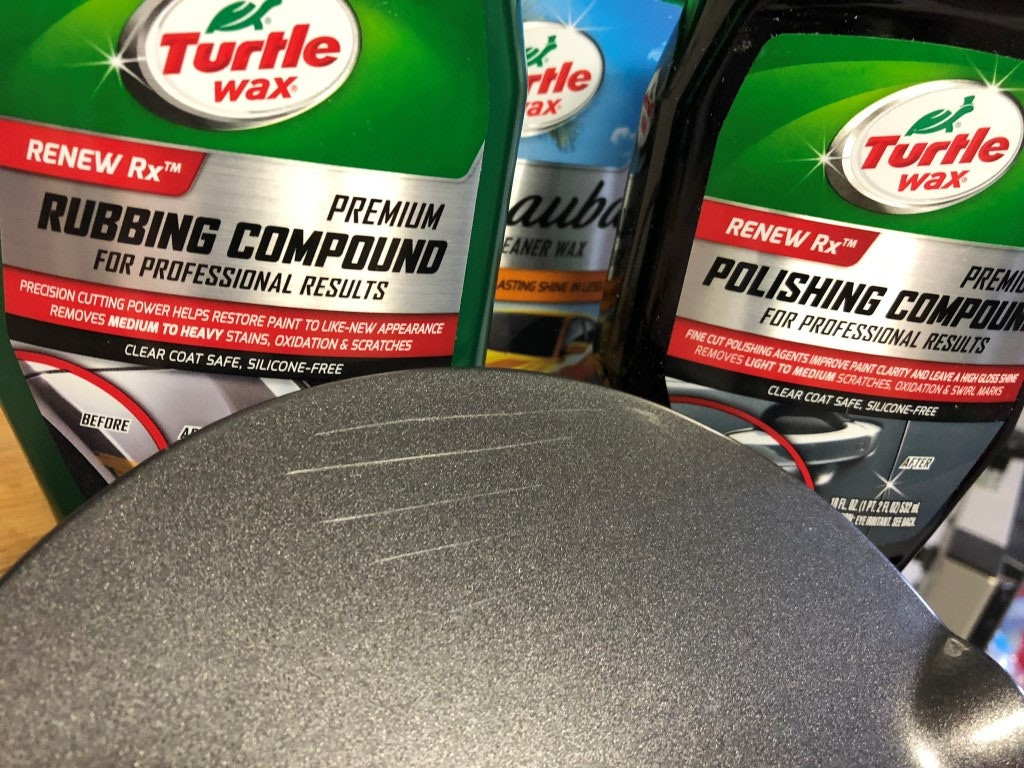

Alt text: Detailed view of a dent and scratches on a car door after a minor collision, showing paint damage.

Weighing the Personal Costs and Benefits of DIY Car Repair

Like most things in life, repairing your car yourself after an accident has both advantages and disadvantages. While it might seem like a cost-saving measure, it’s not always the best choice for everyone, especially after an accident that wasn’t your fault.

At Phoenix Accident and Injury Law Firm, we generally advise starting with an insurance claim. After filing, you have the flexibility to decide how to proceed with repairs. Waiting for insurance compensation might take time, potentially leaving you with ongoing costs. Want to learn more about the best steps to take next?

Phoenix Accident and Injury Law Firm, with over 15 years of experience, is dedicated to helping clients get the compensation they deserve for injuries and car repairs after accidents. Contact our office today for a free consultation by phone or at our Chandler office. We serve clients in Chandler, Gilbert, Mesa, Scottsdale, Tempe, and Peoria, AZ, providing experienced personal injury legal support.

If you’ve been in a car accident and need assistance with getting your car fixed using a settlement, reach out to Phoenix Accident and Injury Law Firm in Chandler, AZ, to discuss your situation with a knowledgeable personal injury attorney.